The FOMO is Real – Top Money Moves You Should Be Making Right Now!

Are you feeling the FOMO when it comes to making smart financial decisions? Don’t worry, you’re not alone. In today’s fast-paced world, it’s easy to feel overwhelmed by the constant stream of financial advice and news. But fear of missing out on crucial money moves can lead to costly mistakes. That’s why it’s important to take control of your finances and make the right choices for your future. In this blog post, we’ll discuss the top money moves you should be making right now to secure your financial well-being.

Firstly, it’s crucial to establish an emergency fund to protect yourself from unexpected expenses and financial setbacks. Additionally, paying off high-interest debt should be a top priority to free yourself from costly interest charges. Investing in a retirement account is another essential money move that will secure your financial future. These are just a few of the important steps we’ll be discussing in this post, so keep reading to learn more about the top money moves you should be making right now!

Key Takeaways:

- Invest Early: Start investing as early as possible to take advantage of compounding interest and maximize your returns over time.

- Create an Emergency Fund: Build a safety net with at least 3-6 months’ worth of expenses to protect yourself from unexpected financial setbacks.

- Set Financial Goals: Establish clear and achievable financial goals to keep yourself motivated and on track towards financial security and success.

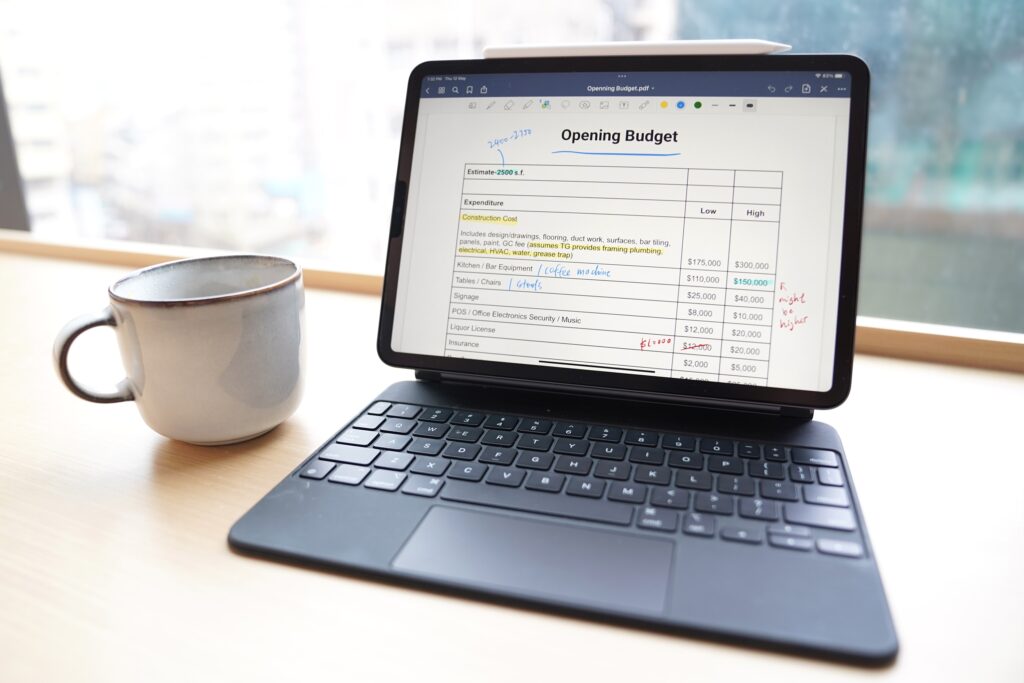

Embracing Your Budget

Clearly, budgeting is an essential part of managing your finances and achieving your financial goals. It provides a roadmap for your money, helping you to prioritize spending, save for the future, and avoid debt. Embracing your budget means taking control of your finances and making deliberate choices about how you allocate your income. It may require some discipline and adjustments to your spending habits, but the long-term benefits are well worth the effort.

The Essentials of Effective Budgeting

When it comes to budgeting, the most important thing is to create a realistic plan that reflects your income, expenses, and financial goals. Start by listing all your sources of income and then categorizing your expenses into fixed (such as rent or mortgage, utilities, and insurance) and variable (such as groceries, entertainment, and dining out).

Make sure to include savings as a non-negotiable expense in your budget. Once you have a clear picture of your financial situation, you can set specific spending limits for each category and track your progress against them.

Another essential aspect of effective budgeting is to regularly review and adjust your budget as needed. Life changes, and so will your financial circumstances. You may need to make changes to accommodate unexpected expenses, rising costs, or changes in your income. By regularly revisiting your budget, you can ensure that it remains relevant and effective in helping you achieve your financial goals.

Tracking Your Spending Habits

Tracking your spending habits is a crucial step in embracing your budget. By keeping a close eye on where your money goes, you can identify any areas where you might be overspending and make necessary adjustments.

Whether you choose to track your expenses through a budgeting app, spreadsheets, or simply keeping receipts, it’s important to have a clear understanding of your spending habits. This will allow you to make informed decisions about where you can cut back and where you might want to allocate more funds in your budget.

Moreover, tracking your spending habits helps you stay accountable to your financial goals, keeping you from falling into the trap of mindless spending. It also highlights any dangerous patterns or negative financial behaviors that could be hindering your progress toward financial stability.

By staying aware of where your money is going, you can feel more in control of your finances and confident in your ability to make smart money moves.

Emergency Fund Establishment

Obviously, life is full of unexpected expenses, from car repairs to medical emergencies. A strong emergency fund is a crucial component of your financial well-being, providing you with a safety net to cover these unforeseen costs without derailing your overall financial plan.

The Importance of a Financial Safety Net

Having an emergency fund is essential because it helps you avoid debt in times of crisis. Unplanned expenses can easily lead to high-interest, short-term debt, making it difficult to get back on track. With an emergency fund in place, you can avoid this cycle of debt and maintain your financial stability.

Additionally, having a financial safety net provides you with peace of mind and a sense of security. In the event of an unexpected expense, you can rest assured knowing that you have the funds available to cover it without having to disrupt your other financial goals.

Guidelines for Your Emergency Savings

When establishing your emergency fund, a good rule of thumb is to aim for three to six months’ worth of living expenses saved up. This should cover the costs of basic necessities such as rent or mortgage, utilities, groceries, and insurance premiums. It’s important to have enough saved to sustain yourself in the event of a job loss or other major financial setback.

Remember that your emergency fund should be easily accessible, so consider keeping it in a high-yield savings account or a money market fund. This way, you can access the funds quickly when needed, without being subject to penalties or fees.

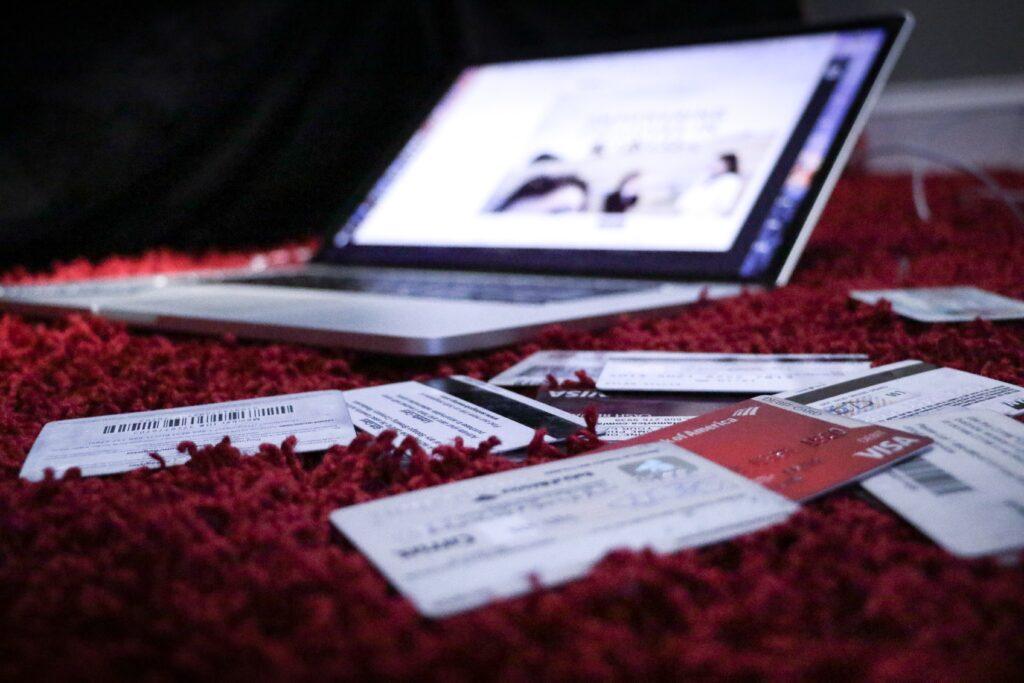

Debt Reduction Strategies

Not addressing your debt can lead to a never-ending cycle of financial stress and missed opportunities. It’s crucial to take control of your debt and start implementing strategies to reduce it. By doing so, you’ll free up more of your income for savings, investments, and enjoying life without the burden of debt hanging over your head.

Assessing Your Debt Situation

The first step in reducing your debt is to assess your current situation. Take a detailed look at all of your outstanding debts, including credit card balances, personal loans, and any other debt you may have. Make a list of each debt, including the current balance, interest rate, and minimum monthly payment. This will help you gain a clear understanding of how much debt you have and the interest you are paying on each account. Knowing the full picture will give you the motivation to take action.

Applying the Debt Snowball vs. Debt Avalanche Methods

When it comes to reducing your debt, there are two popular methods to consider: the debt snowball and debt avalanche. With the debt snowball method, you focus on paying off the smallest debt first while continuing to make the minimum payments on your other debts.

Once the smallest debt is paid off, you then move on to the next smallest debt, and so on. The debt avalanche method, on the other hand, involves paying off the debt with the highest interest rate first, while making the minimum payments on your other debts. The goal is to save the most on interest over time.

Which method is best for you depends on your personal preferences and financial situation. The debt snowball method can provide a quick win and keep you motivated, while the debt avalanche method will save you more on interest in the long run. Your choice will depend on your individual priorities and financial goals.

Investing Fundamentals

After taking care of your emergency fund and paying off high-interest debts, it’s time to start investing. Investing is crucial to building wealth and achieving your financial goals. Whether you’re saving for a down payment on a house, your children’s education, or your retirement, putting your money to work for you is essential. Here are some investing fundamentals you should know.

Diversifying Your Investment Portfolio

When it comes to investing, diversification is key. Spreading your investments across different asset classes, such as stocks, bonds, and real estate, can help minimize risk. If one area of the market underperforms, your losses may be offset by the gains in other areas.

This helps to protect your portfolio from extreme fluctuations and market downturns. Consider diversifying not only across asset classes but also within each class. For example, within stocks, consider investing in different industries and geographic regions.

Retirement Accounts: IRAs and 401(k)s

Contributing to retirement accounts such as IRAs (Individual Retirement Accounts) and 401(k)s is a smart move for your future. These accounts offer tax advantages that can help you grow your money more efficiently. With a traditional IRA or 401(k), your contributions are made with pre-tax dollars, lowering your taxable income for the year. With a Roth IRA or 401(k), your contributions are made with after-tax dollars, but qualifying withdrawals in retirement are tax-free.

Take advantage of any employer matching contributions to your 401(k) – it’s essentially free money that can significantly boost your retirement savings. You have control over the investment options within these accounts, allowing you to tailor your portfolio according to your risk tolerance and retirement timeline.

Boosting Your Income

To achieve financial stability and secure your financial future you need to focus on boosting your income. There are several strategies you can implement to increase your earning potential and bring in more money each month.

Exploring Side Hustles and Passive Income Streams

To diversify your income sources and boost your earnings, consider exploring side hustles and passive income streams. Side hustles can be anything from freelance work, selling handmade products online, to driving for a rideshare service, and more.

These opportunities allow you to make extra money outside of your regular job. Passive income streams, on the other hand, involve making an initial investment of time or money to create a recurring income with little effort on your part. This could include investing in dividend-paying stocks, rental properties, or creating digital products.

Negotiating Salary and Advancing Your Career

To maximize your earning potential, become comfortable with negotiating your salary and seeking opportunities for advancement in your career. Keep track of your accomplishments at work and use them as leverage when negotiating for a higher salary.

Additionally, don’t be afraid to seek out promotions or apply for higher-paying positions within your company or elsewhere. By advancing your career, you can increase your earning potential and create a more secure financial future.

Smart Savings Tactics

Your financial well-being depends on your ability to save money for the future, emergencies, and unexpected expenses. Whether you are just starting to build your savings or looking for ways to optimize your existing savings strategy, there are simple yet powerful money moves you should be making right now to ensure you are on the right track.

High-Yield Savings Accounts and Certificates of Deposit

When it comes to saving money, where you store it matters. Instead of stashing your funds in a traditional savings account with minimal interest rates, consider opening a high-yield savings account or investing in Certificates of Deposit (CDs). These financial products typically offer higher interest rates compared to regular savings accounts, helping your money grow over time.

High-yield savings accounts and CDs are generally low-risk, making them ideal for your emergency fund or long-term savings goals. However, keep in mind that CDs may require you to lock in your money for a specific period, so be sure to choose an option that aligns with your financial objectives.

Utilizing Automatic Savings Plans

To prevent financial procrastination and ensure consistent contributions to your savings, consider setting up automatic savings plans. Automating your savings allows you to allocate a portion of your paycheck directly to your savings account or investment accounts, making it a seamless and hassle-free process

. This method helps you prioritize savings as a non-negotiable expense, reinforcing disciplined financial habits. By automating your savings, you also eliminate the temptation to spend the money impulsively, fostering a consistent and sustainable approach to building your financial security.

Financial Planning and Review

For many people, financial planning can seem overwhelming or even unnecessary. But the truth is, creating and regularly reviewing a financial plan is crucial for your long-term financial health.

Without a plan in place, you may find yourself unprepared for unexpected expenses, unable to reach your financial goals, or caught off guard by changes in your financial situation. By taking the time to create a financial plan and regularly reviewing and adjusting it, you can stay on track to meet your financial goals and avoid unnecessary stress.

Setting Short-term and Long-term Financial Goals

When it comes to financial planning, one of the most important steps you can take is to set clear, achievable financial goals for both the short and long term. Short-term goals might include things like paying off credit card debt, building an emergency fund, or saving for a vacation.

Long-term goals could include saving for a down payment on a house, funding your retirement, or creating a college fund for your children. By setting specific, measurable goals, you can track your progress and stay motivated to continue working towards them.

Regularly Reviewing and Adjusting Your Financial Plan

Once you have a financial plan in place, it’s important to regularly review and adjust it as needed. Your financial situation and goals can change over time, so it’s crucial to revisit your plan on a regular basis. This might mean sitting down every six months to review your progress, or making adjustments as major life events occur.

By staying proactive and regularly reviewing your financial plan, you can ensure that you’re staying on track and making the necessary adjustments to reach your goals. Ignoring the need for regular review and adjustments can lead to missed opportunities and potential financial setbacks.

Protection Through Insurance

Despite the best efforts you take to manage your finances, life can throw unexpected challenges your way. This is where insurance comes in as a crucial tool in your financial toolkit. By providing a safety net for you and your loved ones, insurance gives you peace of mind and protection against potential financial hardships.

Life and Health Insurance Essentials

When it comes to protecting the most important aspects of your life, life and health insurance are essential. Life insurance provides your loved ones with financial security in the event of your passing, helping them cover expenses and maintain their standard of living. On the other hand, health insurance ensures that you are able to access necessary medical care without facing overwhelming financial burdens.

Your life insurance coverage should be sufficient to provide for your family’s needs in the event of your passing. Consider the amount of your outstanding debts, your income, and your family’s living expenses when determining the appropriate coverage amount.

When it comes to health insurance, ensure that you have adequate coverage for routine medical care as well as unforeseen emergencies. It’s important to understand the coverage and any out-of-pocket expenses you may be responsible for.

Property and Casualty Insurance: What You Need to Know

Property and casualty insurance protect you from the financial burden of property damage, liability, and other unexpected events. Homeowners or renters insurance provides coverage for your residence and personal property in the event of damage or theft. It also offers liability protection in case someone is injured on your property.

When it comes to your vehicles, auto insurance is critical for protecting yourself and others in the event of an accident. This coverage can help pay for damage to your vehicle, as well as medical expenses and liability claims in the event of an accident for which you are at fault. Umbrella insurance can provide an extra layer of protection by extending your liability coverage beyond the limits of your other policies.

Ensuring adequate coverage for your life, health, property, and liability needs is crucial for safeguarding your overall financial well-being. Making informed decisions about your insurance coverage can provide you with peace of mind and financial protection should unexpected events occur.

Mindful Spending and Consumer Awareness

Keep your spending in check by being mindful of your purchases and practicing consumer awareness. It’s important to be conscious of where your money is going and to make sure that you’re not falling into the trap of unnecessary spending. By being more aware of your financial decisions, you can make smarter choices and ultimately save more money in the long run.

Avoiding Impulse Purchases and Marketing Traps

When it comes to avoiding impulse purchases and marketing traps, it’s all about being aware of your triggers. Retailers and advertisers are skilled at creating enticing promotions and marketing campaigns that make you feel like you need to make a purchase on the spot. This can lead to unnecessary spending and buyer’s remorse.

To avoid falling into this trap, it’s important to take a step back and evaluate whether a purchase is truly necessary or if it’s just a result of clever marketing tactics. Consider implementing a waiting period before making a purchase to ensure that you’re not being swayed by impulsive urges. Be mindful of the power of sales and limited-time offers, as they can create a false sense of urgency that may lead to unnecessary spending.

Maximizing Rewards and Cashback Opportunities

One way to make your spending work for you is by maximizing rewards and cashback opportunities. Many credit cards and loyalty programs offer rewards and cashback incentives for everyday purchases.

By taking advantage of these programs, you can earn valuable rewards and cashback on your purchases, effectively getting more value out of your spending. Look for credit cards that offer rewards for categories you frequently spend in, such as groceries, gas, or dining.

Also, consider joining loyalty programs for retailers that you frequent, as they often offer exclusive discounts and cashback opportunities. By being strategic with your spending, you can maximize the benefits of these programs and get more out of every dollar you spend.

Conclusion

Presently, it’s time for you to take control of your financial future by making these simple money moves. By following the tips provided in this article, you can start building a solid financial foundation for yourself and your family.

Remember, the FOMO (Fear Of Missing Out) can be a powerful motivator, but it’s important to stay focused on your own financial goals and priorities. By implementing these money moves, you can ensure that you are on the right track to financial success.

Don’t let the fear of missing out on opportunities prevent you from taking control of your finances. By making these simple money moves, you can set yourself up for a more secure and prosperous future.

It’s never too late to start making positive changes in your financial habits, and by taking action now, you can begin to see the benefits almost immediately. So don’t wait any longer – start implementing these money moves today and take the first steps towards achieving your financial goals.